Ne faites pas courir des risques inutiles à votre entreprise avec une marge de profit improvisée

La marge de profit sur tout produit ou service que vous offrez doit être établie après une analyse financière sérieuse sur les coûts indirects et les profits projetés sur un volume de travail donné. Soyez certains d’utiliser les marges de profits suggérées par un tiers, surtout s’ils ont fait les calculs nécessaires pour les établir. Environ 9 entrepreneurs sur 10 doivent abandonner leur entreprise parce qu’ils ne savent pas comment calculer les coûts réels de leur entreprise. Ils tentent de deviner qu’elle serait la marge de profit idéale ou quel entrepreneur il devrait copier.

Mark-ups on any product or service you sell need to be based on projected overhead costs and net profit requirements for producing a specified volume of work. Be careful using someone else’s mark-up suggestions, particularly if they have not done the math to figure it out.

Fact is about 9 out of 10 contractors eventually go out of business because they don’t know the true costs of doing business. They are either guessing at what mark-up to use or guessing at which contractor’s mark-up they should copy.If you’re going to risk copying the mark-up of another contractor, make sure you get your mark-up info from that 1 out of 10.

Think about it, it’s like asking how much money you need for gas to drive across county. Depends on where you start, cost of the gas, how fast you drive, how many miles/gallon, summer or winter, who’s driving…

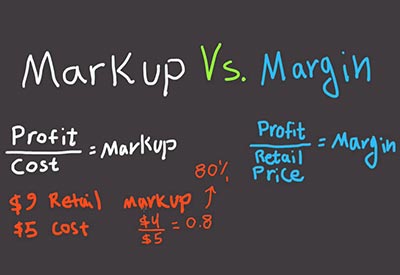

Also, many magazine articles advise contractors to apply a “professional mark-up” to their bids. But what, exactly, is a professional mark-up? Does a 50% mark-up make you a professional, or should you apply 67% to qualify? The simple answer is, if you don’t know what mark-up your company needs to use, you’re not a professional, and therefore you’re not using a professional mark-up. But if you know the formulas for determining margin and mark-up, you have a working financial tool, rather than a magic number suggested by some remodelling guru or pulled out of a hat by another remodeler.

Different mark-ups, same price

To determine your company’s mark-up, divide your anticipated annual indirect costs (costs of overhead and profit) by your anticipated annual direct costs (costs to produce projects):

Therefore, if one company considered its field employees’ health insurance a direct cost, and another company defined it as an indirect cost, those two companies would apply different mark-ups. In theory, if both companies had all of their other costs covered somewhere within their annual budget or estimate, they’d sell their projects at the same price, even though their mark-ups differed.

Remember this the next time you’re impressed or puzzled by what your fellow contractors claim to be using as a mark-up.

Shawn McCadden is a consultant, educator and speaker for the remodelling industry who offers business consulting and coaching services for remodelling business owners who want more for and from their businesses and their lives.He also consults with construction-related product manufacturers and suppliers, helping them understand, find, educate and better serve remodelers. Check out Shawn’s website and blog.